Business property insurance

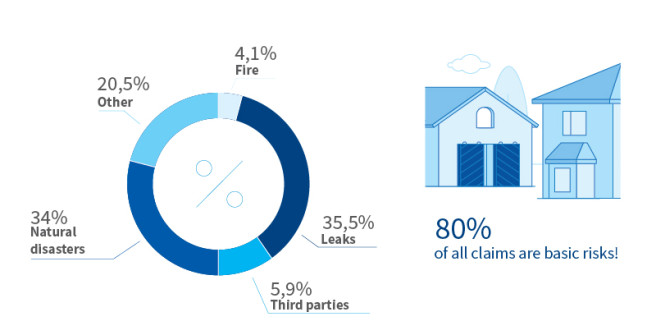

Property insurance covers damage to and loss of the company’s movable and immovable property. The most common causes of damage include flooding due to burst pipes, damage caused by individuals, theft, storms and fires.

Insurance will help you restore or replace your property as quickly as possible and keep your business running.

-

Clear and transparent insurance terms.

-

We compensate anything from small claims to claims with millions of euros of damage.

-

More than 4500 Latvian companies choose BALTA property insurance.

Insured property

-

Real estate

We insure buildings and structures, their parts, or even just their interior finish if the premises are leased.

-

Movable property and equipment

We insure equipment, gear, stock of goods and raw materials, as well as other movable property.

-

Lost profits

We offer business interruption insurance. It is useful if an incident in the company requires a temporary shutdown or restriction of its business to restore its equipment or premises. The insurance will cover the fixed costs and lost profits until the property is restored.

Additional insurance coverage is provided for:

- grounds improvements, i.e., fences, gates, recreation areas, lighting, and other items on the grounds of the building;

- aliquot share of a shared property, e.g., shared-use rooms of a building;

- accidents caused by workers damaging the glazing, damaging property with a vehicle, or water leaking through pipes.

Submitting a claim

Feel safe about your company’s real estate, because our claims team will help your company get back in business as quickly as possible.

Our claims experts are available on weekdays and on weekends to provide advice, to inspect the property after the accident, and to organise any work necessary to prevent further damage.

Submit your claim quickly and easily at any time on website or through our app, as well as by calling 67533375.

Follow the progress of the case for your claim by logging in to balta.lv or the My BALTA section of the app.

Frequently asked questions

Our experts will assess whether your premises need an alarm system, but in most cases, this is not a requirement. If you have an alarm system installed on your premises, the insurance policy will cost less.

No, there is no need to prepare the documents. We will prepare the insurance policy according to the information you provide. Remember that you must provide true information.

Yes, you can separately buy insurance only for your company’s movable property.

Of course, you can also insure equipment and other special machinery that your company leases from third parties.

Yes, you can also insure your company’s property during renovation or construction. We have created a special insurance policy specifically for this purpose. Find out more about this option in the Construction section.

If your company’s property has been damaged, we offer two options for compensation:

1) BALTA credits the insurance proceeds to the company’s account. The company then chooses a contractor to do the repairs and submits a cost estimate to BALTA. Or BALTA calculates the damage, and the company approves the estimate for the payment of compensation;

2) BALTA pays for repairing the company's property by transferring money to the repairs contractor or by paying for the purchase of equivalent property.

BALTA pays insurance proceeds to cover the purchase of the same or equivalent new property according to its current purchase value. If the property is more than 10 years old, the amount of the proceeds is reduced by 25% for depreciation and loss of value.

The price of a company property insurance policy depends on the value of the property and the company’s field of business. We recommend consulting with BALTA’s specialists to get a property insurance quote prepared specifically for you.