Accident insurance

Accident insurance will provide financial support in the event of accidents and injuries (dislocations, frostbite, poisoning, bites, etc.).

-

Extensive basic coverage with no deductible – valid worldwide.

-

No hidden conditions – more than 50 leisure and sports activities are included in the coverage at no extra cost.

-

Easy claiming via the mobile app, balta.lv or by calling 67533375 and fast claim payment.

-

Financial security in the case of injury

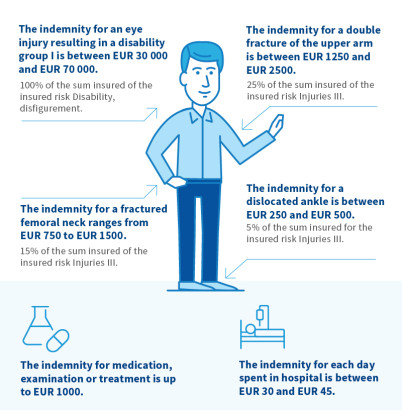

Receive indemnity according to the policy cover you choose, the type and severity of the injury.

-

Medical expenses paid

We will indemnify you for unexpected medical expenses if they are incurred within one year of the accident.

-

Hospital allowance

We will pay a daily allowance for each day spent in an inpatient overnight hospital for up to 100 days.

Which risks can be included in an accident insurance policy, and what do they cover?

In the event of an injury (burns, frostbite, broken bones, bites, poisoning, sprains, abrasions, etc.), we will pay compensation for the injury according to the coverage of the policy you have chosen and the type and severity of the injury. In the case of a compound fracture (open fracture of a bone or damage to surrounding tissue as a result of the fracture), we will increase the indemnity amount by 25%.

If the injury results in the loss of ability to work, we will provide financial support for each day of temporary incapacity for work up to 90 working days per event, with no limit on the number of days during the policy period.

If a child under 7 years of age is injured and the parent has an incapacity to work certificate, we will pay for up to 10 days of incapacity to work if BALTA accident insurance has been purchased for the child.

Please keep in mind! We will only pay the indemnity if the income at the time of the accident is earned in paid employment in the Republic of Latvia.

If the injury requires inpatient overnight hospital treatment, we will pay a daily allowance for each day spent in hospital up to 100 days per incident, with no limit on the number of days during the policy period.

We will pay a one-off indemnity equal to the sum insured for the Critical Illness risk if you are diagnosed with any critical illness during the policy period: malignancy, stroke, myocardial infarction, Alzheimer’s disease, chronic renal failure, multiple sclerosis, type I diabetes, blindness, paralysis or loss of limbs, aplastic anaemia.

Please keep in mind! A waiting period (90 days from the policy start date) and a survival period (first 25 days from the onset of the disease) apply to this risk when the policy is purchased. The waiting period does not apply in situations where an insurance contract which includes the risk Critical Illness is renewed without interruption.

Izmaksāsim vienreizēju kompensāciju riska “Bīstamas slimības” apdrošinājuma summas apmērā, ja apdrošināšanas darbības laikā tiks diagnosticēta kāda bīstamā slimībā: difterija, gāzes gangrēna, holēra, jersinioze, leptospiroze, malārija, meningokoku infekcija, stingumkrampji, trakumsērga, trihineloze.

Ņem vērā! Iegādājoties polisi, šim riskam tiek piemērots nogaidīšanas periods: 20 dienas. Nogaidīšanas periods neattiecas uz situācijām, kad apdrošināšanas līgums, kurā ir bijis iekļauts risks “Bīstamās slimības”, tiek atjaunots bez pārtraukuma.

We will pay a one-off indemnity equal to the sum insured for the risk Tick-borne Diseases if a tick-borne disease is diagnosed during the insurance period: tick-borne encephalitis, myelitis, encephalomyelitis, Lyme disease.

Please keep in mind! A waiting period applies for this risk when the policy is purchased: 20 days. The waiting period does not apply in situations where an insurance contract which includes the risk Tick-borne Diseases is renewed without interruption.

We will indemnify unexpected medical expenses related to the injury if they are incurred within one year from the date of the injury.

|

Insured risk |

Which expenses will we indemnify? |

|

Outpatient and inpatient medical care |

Patient fees and charges for outpatient services: doctor-specialist consultations, laboratory and diagnostic tests, medical manipulations (bandages, plaster, splints, blocks, etc.) and physical treatments prescribed by a doctor (maximum 10). |

|

Magnetic resonance imaging and computed tomography |

Magnetic resonance imaging and computed tomography examinations for a fee, as prescribed by a doctor. |

|

Paid surgeries and prosthetics |

Paid services in an inpatient day and overnight inpatient hospital for surgical treatment of the injury. |

|

Dentistry |

Dental services for traumatic dental injuries, including dentures. Expenses for dental implants are reimbursed at 50%. |

|

Cosmetic surgeries |

Plastic and microsurgical surgeries for the correction and prevention of facial disfigurements resulting from trauma. |

|

Rehabilitation expenses |

Outpatient and inpatient rehabilitation services prescribed by the attending physician, received within 60 days after the injury has been treated in an inpatient overnight hospital or in the case of a complex fracture of a bone. Rehabilitation services include therapeutic massage, physical therapy, aquatic treatments, taping, sling therapy, therapeutic gymnastics, inpatient rehabilitation services on a day and overnight basis (including horse-riding therapy and passive movement training). |

|

Medicinal products |

Expenses for the purchase of medicines and dressings to treat the effects of an injury. |

|

Purchase or rental of technical aids |

The purchase or hire of orthoses, splints, bandages and technical aids (canes, crutches, wheelchairs) prescribed by a doctor, as well as the purchase of 3D immobilisation plaster in the case of a fractured bone. |

|

Transportation costs |

Medical transport from the place of the accident to the nearest medical facility and from the hospital to the place of residence if such transport is required on the doctor’s instructions. |

|

Medical expenses abroad |

Medical expenses for outpatient and inpatient emergency medical treatment and for the purchase of medicines abroad to treat the acute condition. |

|

Insured risk |

Which expenses will we indemnify? |

|

Death

|

If the injury results in the death of the insured person, we will pay the full sum insured to the beneficiary named in the policy. |

|

Children’s tuition fees

|

If the injury results in the death of the insured person, we will indemnify the tuition fees of the client’s dependent children at a higher education institution in accordance with the terms of the insurance contract. |

|

Funeral benefit

|

If the injury results in the death of the insured person, we will pay the funeral expenses in Latvia. |

|

Disability, disfigurement

|

One-off compensation if the injury results in disability or disfigurement. The amount of compensation is determined in accordance with the provisions of the insurance contract. |

|

Social care

|

If the injury results in a disability group I or total loss of a limb, we will pay for social care expenses for the first three months after the accident and for the appropriate adaptation of your permanent residence. |

|

Psychological help

|

We will cover the cost of psychological assistance (counselling by a psychologist, psychotherapist or psychiatrist) in the event of a situation covered by the insurance conditions. |

|

Professional retraining expenses

|

We will cover the costs of retraining (courses) necessary to learn a new profession if the injury has caused a disability group I or II and it is not possible to continue to carry out the duties of the trade. |

|

Child’s well-being |

When you make an accident insurance claim for a child under 18, we will not only cover the injury but also one or more additional bonuses of your choice according to the policy cover: - child’s welfare: purchase of sweets, snacks or fruit, visit to a water or amusement park, zoo, nature park, swimming pool, cinema or theatre, purchase of a children’s toy; - child’s education: private tuition. We will indemnify you for any loss due to an injury resulting from non-attendance at a sports camp or educational club; - school kit: we will indemnify the loss of a child’s personal belongings damaged as a result of an injury. The amount of compensation is determined according to the terms of the insurance contract. |

Choose the right programme and be protected in different life situations!

Choose from 16 different accident insurance programmes.

|

Insured risks for each insured person |

Bronze |

Silver |

Gold |

|

Death |

5000 |

15 000 |

25 000 |

|

Disability, disfigurement |

5000 |

15 000 |

25 000 |

|

Injuries III |

2000 |

3000 |

5000 |

|

Child’s well-being* |

|

415 |

820 |

|

* Child’s welfare |

|

15 |

20 |

|

Child’s education |

|

200 |

400 |

|

School kit |

|

200 |

400 |

|

Hospital allowance |

4000 |

7000 |

10 000 |

|

Daily allowance** |

|

|

|

|

Medical expenses (risk group): |

1000/300 |

2000/750 |

4000/1000 |

|

• Outpatient and inpatient medical care |

300 |

750 |

1000 |

|

• Magnetic resonance imaging and computed tomography |

100 |

200 |

300 |

|

• Paid surgeries and prosthetics |

300 |

500 |

700 |

|

• Dentistry |

150 |

375 |

500 |

|

• Cosmetic surgeries |

300 |

750 |

1000 |

|

• Rehabilitation expenses |

100 |

200 |

300 |

|

• Medicinal products |

300 |

750 |

1000 |

|

• Purchase or rental of technical aids |

150 |

375 |

500 |

|

• Transportation costs |

300 |

750 |

1000 |

|

• Medical expenses abroad |

150 |

375 |

500 |

|

Social care |

0 |

3000 |

1000 |

|

Critical illnesses A |

|

700 |

1000 |

|

Tick-borne diseases |

|

|

500 |

|

Dangerous diseases |

|

|

750 |

|

Children’s tuition fees |

0 |

1000 |

3500 |

|

Funeral benefit |

0 |

500 |

800 |

|

|

|

|

|

|

Psychological help |

|

500 |

1000 |

|

Professional retraining expenses |

|

5000 |

5000 |

|

|

|

|

|

|

|

STANDARD |

EXTRA |

VIP |

VIP LUX |

||||||

|

Insured risks |

Variant 1 |

Variant 2* |

Variant 3* |

Variant 1* |

Variant 2* |

Variant 3* |

Variant 1* |

Variant 2* |

Variant 3* |

|

|

Death |

4000 |

7000 |

9000 |

10 000 |

15 000 |

20 000 |

30 000 |

50 000 |

70 000 |

100 000 |

|

Disability, disfigurement |

4000 |

7000 |

9000 |

10 000 |

15 000 |

20 000 |

30 000 |

50 000 |

70 000 |

100 000 |

|

Injuries III |

1500 |

2500 |

3000 |

3000 |

3500 |

4000 |

5000 |

6000 |

10 000 |

10 000 |

|

Child’s well-being* |

|

|

415 |

415 |

415 |

515 |

820 |

920 |

920 |

1030 |

|

* Child’s welfare |

|

|

15 |

15 |

15 |

15 |

20 |

20 |

20 |

30 |

|

Child’s education |

|

|

200 |

200 |

200 |

300 |

400 |

400 |

500 |

500 |

|

School kit |

|

|

200 |

200 |

200 |

200 |

400 |

400 |

400 |

500 |

|

Hospital allowance |

4000 |

5000 |

6000 |

6000 |

8000 |

10 000 |

10 000 |

12 000 |

15 000 |

15 000 |

|

Daily allowance** |

|

|

|

|

|

|

|

|

|

9000 |

|

Medical expenses (risk group): |

300 |

500 |

700 |

700 |

750 |

800 |

800 |

900 |

1000 |

1000 |

|

• Outpatient and inpatient medical care |

300 |

500 |

700 |

700 |

750 |

800 |

800 |

900 |

1000 |

1000 |

|

• Magnetic resonance imaging and computed tomography |

300 |

500 |

700 |

700 |

750 |

800 |

800 |

900 |

1000 |

1000 |

|

• Paid surgeries and prosthetics |

300 |

500 |

700 |

700 |

750 |

800 |

800 |

900 |

1000 |

1000 |

|

• Dentistry |

150 |

250 |

350 |

350 |

375 |

400 |

400 |

450 |

500 |

500 |

|

• Cosmetic surgeries |

300 |

500 |

700 |

700 |

750 |

800 |

800 |

900 |

1000 |

1000 |

|

• Rehabilitation expenses |

150 |

250 |

350 |

350 |

375 |

400 |

400 |

450 |

500 |

500 |

|

• Medicinal products |

300 |

500 |

700 |

700 |

750 |

800 |

800 |

900 |

1000 |

1000 |

|

• Purchase or rental of technical aids |

150 |

250 |

350 |

350 |

375 |

400 |

400 |

450 |

500 |

500 |

|

• Transportation costs |

300 |

500 |

700 |

700 |

750 |

800 |

800 |

900 |

1000 |

1000 |

|

• Medical expenses abroad |

300 |

500 |

700 |

700 |

750 |

800 |

800 |

900 |

1000 |

1000 |

|

Social care |

- |

1000 |

3000 |

3000 |

4000 |

4000 |

5000 |

5000 |

5000 |

5000 |

|

Critical illnesses A |

|

|

|

500 |

600 |

700 |

1000 |

1300 |

2000 |

3000 |

|

Tick-borne diseases |

- |

200 |

300 |

- |

400 |

500 |

500 |

600 |

700 |

700 |

|

Dangerous diseases |

- |

300 |

400 |

- |

600 |

700 |

750 |

1000 |

1250 |

1300 |

|

Children’s tuition fees |

- |

- |

1000 |

1000 |

2000 |

2500 |

3000 |

3500 |

3500 |

5000 |

|

Funeral benefit |

- |

- |

500 |

- |

500 |

700 |

800 |

900 |

1000 |

1000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Psychological help |

- |

- |

300 |

400 |

500 |

500 |

700 |

700 |

1000 |

1000 |

|

Professional retraining expenses |

- |

- |

500 |

- |

5000 |

5000 |

7500 |

7500 |

7500 |

10 000 |

|

INSURED RISKS |

1. variant |

2. variant |

3. variant |

|

|

Death |

3000 |

5000 |

7000 |

|

|

Disability, disfigurement |

3000 |

5000 |

7000 |

|

|

Social care |

- |

- |

500 |

|

|

Injuries III |

1500 |

2000 |

3000 |

|

|

Child’s well-being |

15 |

215 |

415 |

|

|

· Child’s welfare |

15 |

15 |

15 |

|

|

· Child’s education |

- |

100 |

200 |

|

|

· School kit |

- |

100 |

200 |

|

|

Hospital allowance |

2000 EUR 6 per day |

4000 EUR 12 per day |

7000 EUR 21 per day |

|

|

Tick-borne diseases |

- |

200 |

400 |

|

|

Dangerous diseases |

- |

- |

300 |

|

|

Psychological help |

- |

- |

300 |

|

|

Medical expenses (risk group): |

- |

300 |

500 |

|

|

· Outpatient and inpatient medical care |

- |

300 |

500 |

|

|

· Magnetic resonance imaging and computed tomography |

- |

300 |

500 |

|

|

· Paid surgeries and prosthetics |

- |

300 |

500 |

|

|

· Dentistry |

- |

150 |

250 |

|

|

· Cosmetic surgeries |

- |

300 |

500 |

|

|

· Rehabilitation expenses |

- |

150 |

250 |

|

|

· Medicinal products |

- |

300 |

500 |

|

|

· Purchase or rental of technical aids |

- |

150 |

250 |

|

|

· Transportation costs |

- |

300 |

500 |

|

|

· Medical expenses abroad |

- |

300 |

500 |

|

Get a consultation, to find out more or to purchase one of these programmes.

Accident insurance claims statistics

While a paid claim cannot undo an accident, it can provide essential financial support at a difficult time. The number of BALTA accident insurance clients increases every year, and the amount of claims paid has increased significantly over the last three years. Over the last three years:

-

received more than

27 000

claims

-

indemnity paid out more than

EUR 6 million

What amount of indemnity will I receive if I have an accident?

Here are some examples of indemnities in the event of an injury, but please note that this is influenced by both the insurance coverage you choose and the severity of the injury, so we consider all claims on an individual basis.

Submitting a claim

Submit your claim quickly and easily at any time on website or through our app, as well as by calling 67533375.

Follow the progress of your claim by logging in to balta.lv or checking the My BALTA section of the app.

* Examples of indemnity costs are calculated assuming you have purchased one of the VIP accident insurance programmes.

The experience of BALTA client Ginta

- A medical certificate from the attending physician confirming the diagnosis.

- For a minor: the child’s birth certificate.

In the case of fractured bones: a statement giving the exact diagnosis, together with examinations (such as X-rays) confirming the diagnosis. - For indemnity for medical expenses: copies of prescriptions and proof of payment (cheques, receipts) containing the recipient’s personal details and a transcript of the service received.

- For the indemnity of hospital allowance expenses: inpatient certificate.

- For the payment of a daily allowance in the case of incapacity to work: e-incapacity certificate (information from the EDS system) and employer’s confirmation of absence from work. If the temporary incapacity to work is longer than 10 days or the incapacity to work is for childcare, a decision of the State Social Insurance Agency on the granting of sickness benefit must be submitted.

- For the payment of an indemnity for invalidism or disfigurement: decision of the State Medical Commission for the Assessment of Health Condition and Working Ability establishing invalidism; for disfigurement, a medical certificate from the attending physician.

- For the payment of expenses in the event of social care in the event of adaptation of a residence or car: photographs of the rebuilt premises or adapted vehicle showing the object before and after the reconstruction or adaptation.

- In the event of death: death certificate of the insured person, a medical certificate on the cause of death and a document certifying the beneficiary’s right to the insurance indemnity.

- For funeral expenses: documents proving the funeral expenses (invoices, receipts, etc.).

- Other documents at the request of BALTA.

Frequently asked questions

In the event of an accident, you should see a doctor immediately but no later than within 24 hours to get the medical attention you need. If the accident is related to a road traffic accident or the unlawful actions of third parties, the police should be informed immediately.

Keep all documents confirming both the accident and the injury, such as medical or police certificates, statements, receipts, invoices, as this information will be needed to claim and receive indemnity.

Please note that you can claim an accident indemnity within 60 days of the accident.

On average, we take a decision on the insurance claim within five working days after receiving all the necessary documents. In particularly complex cases, the decision-making time may be longer, but no longer than 30 days.

We have developed 16 different accident insurance programmes, and everyone can choose the one that suits them best. However, if no programme meets your needs, we will offer you an individual solution.

If the accident insurance policy includes the risk Tick-borne Diseases and one of the tick-borne diseases (tick-borne encephalitis, myelitis, encephalomyelitis, Lyme disease) is diagnosed during the insurance period, we will pay one-off compensation equal to the sum insured for the risk.

Please keep in mind! A waiting period applies for this risk when the policy is purchased: 20 days. The waiting period does not apply in situations where an insurance contract which includes the risk Tick-borne Diseases is renewed without interruption.

The accident insurance takes effect from the first day stated in the policy. A waiting period applies for certain risks covered by the policy:

- tick-borne diseases: waiting period 20 days;

- dangerous diseases: waiting period 20 days;

- critical illnesses: waiting period 90 days.

The waiting period does not apply in situations where the insurance contract containing the risk in question is renewed without interruption.

If the accident occurs abroad, you must see a doctor immediately but within 24 hours at the latest to get the medical attention you need. If the accident is related to a road traffic accident or the unlawful actions of third parties, the police should be informed immediately.

Keep all documents confirming both the accident and the injury, such as medical or police certificates, statements, receipts, invoices, as this information will be needed to claim and receive the indemnity.

Please note that you can claim an accident indemnity within 60 days of the accident.

No, we will only indemnify the daily subsistence allowance in the event of incapacity to work if incapacity for work was issued in Latvia.

If the accident insurance policy includes the risk Medical Expenses Abroad, we will indemnify the costs of emergency medical treatment and acute medication received on an outpatient or inpatient basis, depending on the severity of the injury, even if the accident occurred abroad.

When claiming accident insurance for a child under 18 years of age, in addition to the injury indemnity, we will pay for the cost of any of the optional extras: purchase of sweets, snacks or fruit, visits to a water or amusement park, zoo, nature park, swimming pool, cinema or theatre, purchase of a children’s toy.

Yes, you can. In the event of an injury, indemnity will be paid under all policies in force.